The current struggle to spot risks correctly

Blind Decisions

High Costs

Slow Process

No Visibility

Blind Decision-Making Without Data

- Majority of corporates rely on gut feel and word-of-mouth instead of objective data

- Limited access to real-time counterparty financial health information

- Subjective parameters replace data-driven creditworthiness intelligence

- Lack of standardized frameworks for risk evaluation

- Decision-makers struggle to determine deal viability and appropriate exposure values

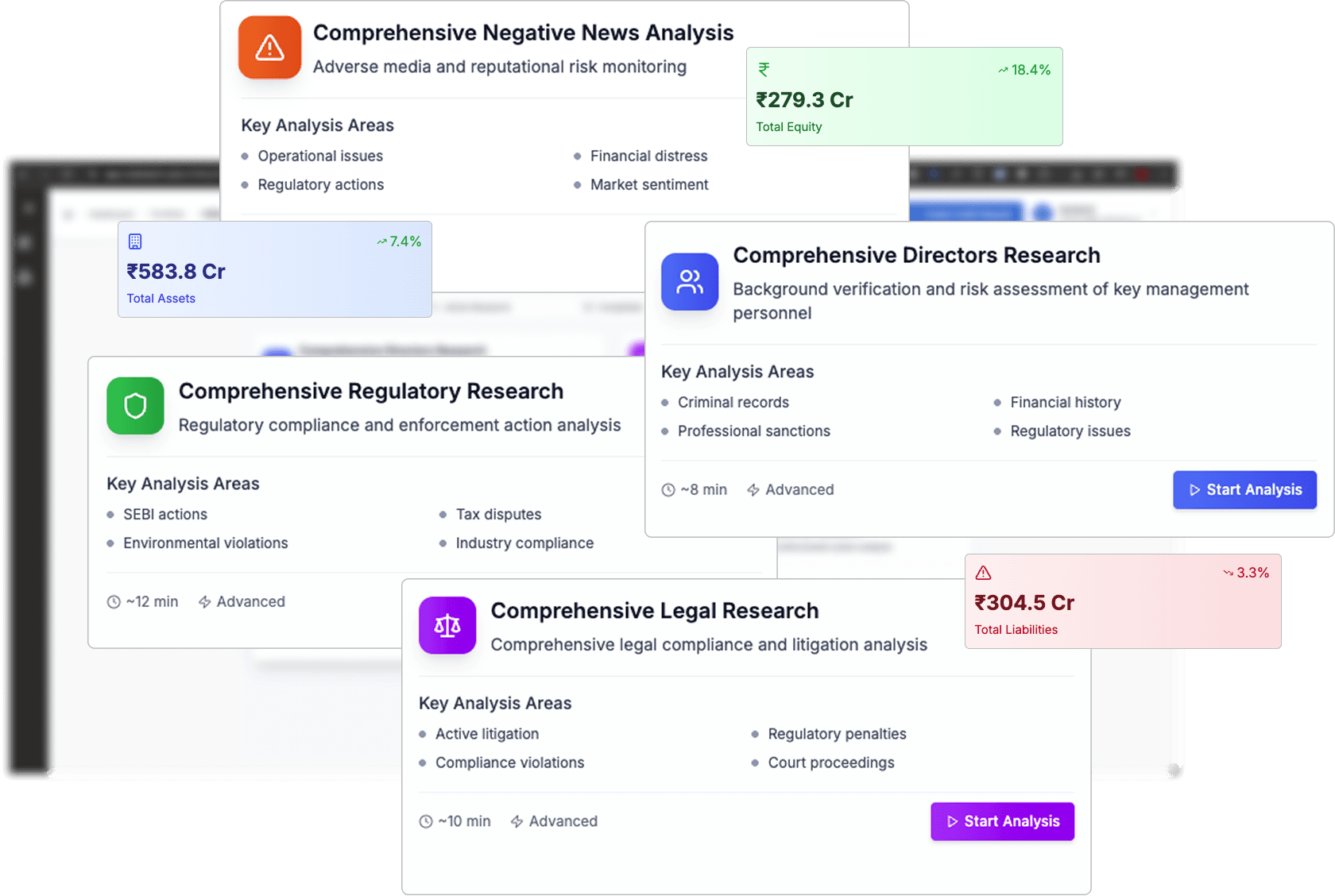

The Intelligent Platform for Due Diligence

Relevant Data + Intelligence

Relevant Data + Intelligence

Curated by Ex-Bankers & Credit-Risk Experts

Industry-Specific Assessments

Tailored insights based on sector trends & benchmarks

Real-Time Reports

AI-driven updates with latest financials, news, and regulatory filings

Faster Turnaround

Automation speeds up decision-making from days to minutes

Active Portfolio Monitoring

Early Warning Alerts & API integrations for dynamic risk tracking

Zero Human Error

AI-driven insights based on Proprietary scoring models, no manual intervention